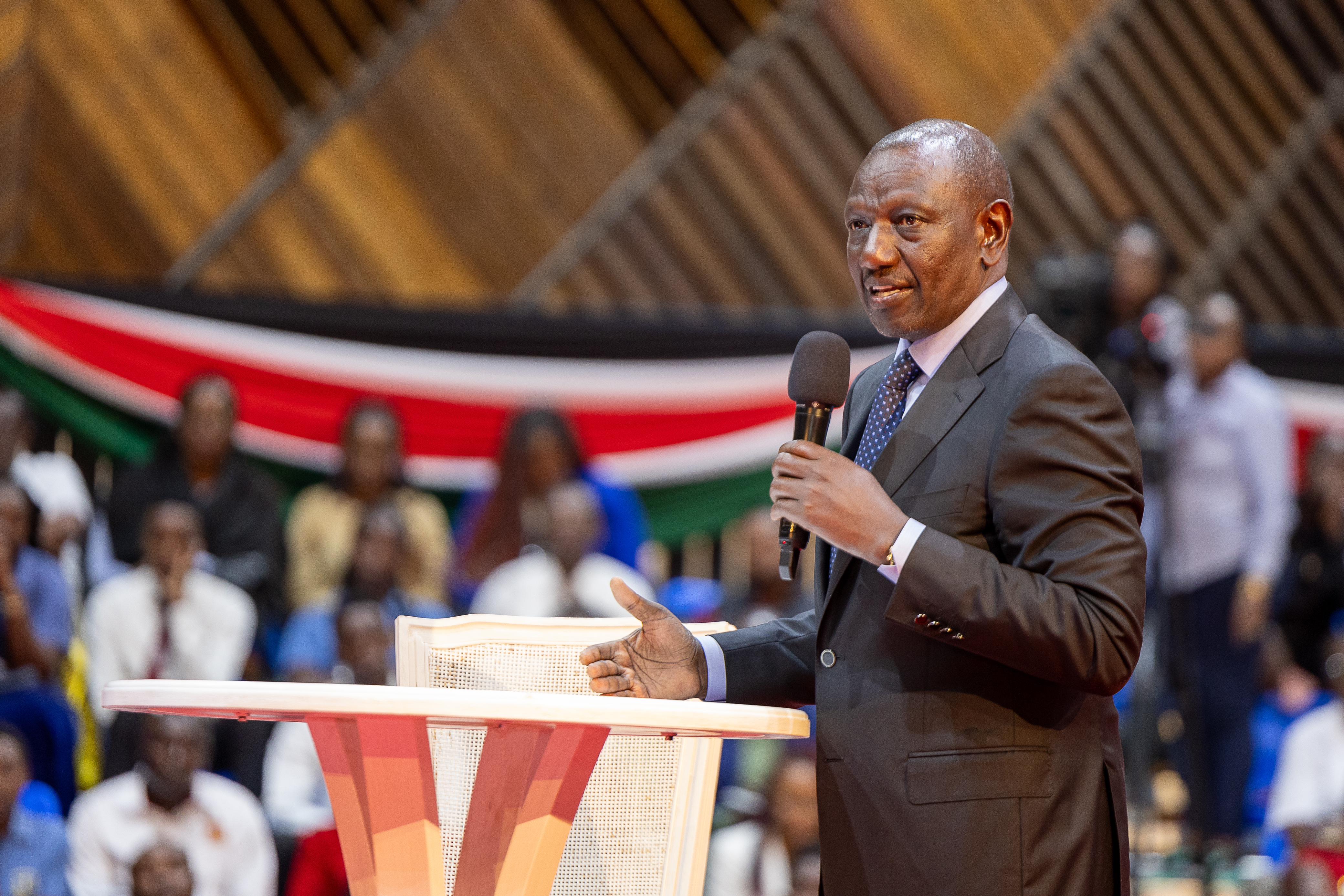

Nairobi, Kenya- President William Ruto has announced plans to tax content creators benefiting from a monetization scheme he negotiated in April 2024.

Speaking at the Kenya Private Sector Alliance’s 20th Anniversary celebration in Nairobi, Ruto highlighted that the initiative allows Kenyan creators to earn significant income through platforms like TikTok and Facebook. He emphasized that taxing these creators would promote fairness among taxpayers.

“I negotiated with TikTok and Facebook, making Kenya one of only four countries where creators can monetize their accounts,” Ruto stated. “Some creators now earn up to Ksh.1 million. Someone earning Ksh.20,000 or Ksh.30,000 pays tax. If you earn Ksh.1 million, isn’t it fair to contribute to the tax kitty, especially when we’ve enabled you to achieve that? It makes sense to me,” he added.

The government is moving forward with plans to tax the digital space through the Tax Laws (Amendment) Bill, 2024, which seeks to include digital operators in the tax framework. The bill is currently undergoing public participation before its Second Reading in Parliament.

In April, Ruto announced agreements with Google, META, and TikTok to enable Kenyan creators to monetize their content. He lauded the country’s youth for their creativity across various fields, including music, digital animation, and virtual reality.

However, Ruto’s claim that Kenya is one of only four countries monetizing creators’ content conflicts with Google’s policies, which list 12 African countries in YouTube’s monetized markets.

These include Kenya, Morocco, Nigeria, South Africa, Tunisia, Uganda, Zimbabwe, Egypt. Algeria, Ghana, and Libya.

For Meta, the platform has been providing the monetisation option for content creators for quite some time but the options were limited to brands and sponsored campaigns.